According to Bloomberg Economics, real estate prices around the world are reminiscent of warnings about bubbles that have not existed since the 2008 financial crisis.

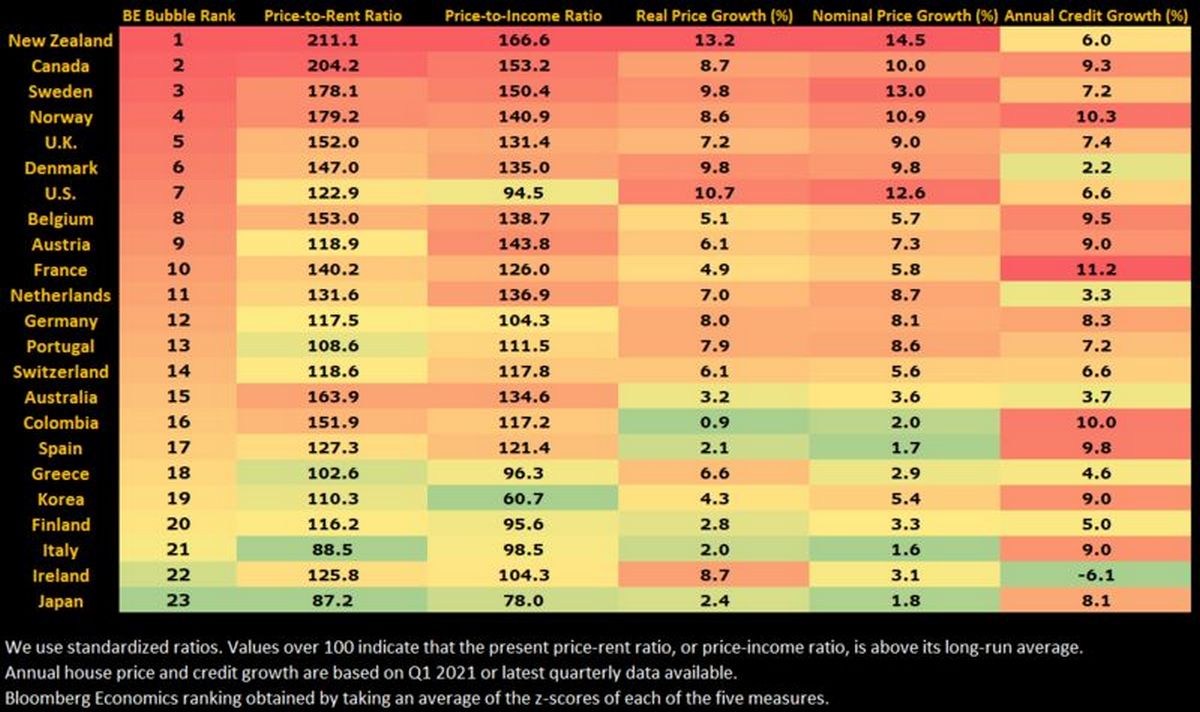

Among the most popular housing markets are New Zealand, Canada and Sweden. This was reported by Bloomberg with reference to key indicators. The UK and US are also at the top of the rankings.

“The combination of factors such as record low interest rates, unprecedented financial incentives, savings during the blockade, limited housing availability and expectations of a strong economic recovery have pushed prices up,” economist Niraj Shah said in a report.

The analysis focused on the member countries of the Organization for Economic Cooperation and Development. According to the study, workers who stay at home and need more space, and tax breaks offered by some governments to homebuyers, also stimulate demand.

The Bloomberg Economics dashboard has five indicators for assessing a country’s “bubble rating,” with a higher score indicating a higher risk of correction. Among the indicators of the ratio of price to rent and price to income helps to assess the sustainability of price growth. Rising house prices measure the current momentum.

According to an analysis by Bloomberg Economics, for many OECD countries, price ratios are higher than on the eve of the 2008 financial crisis.

Recently, there are data showing that, for example, in the fourth quarter of 2020, housing prices in OICP countries will increase by almost 7% annually or at the highest level. According to Shah, however, in the future we will witness a cold, not a collapse.

Many buyers choose real estate outside the city. For example, in the UK in an area near London, property prices are about 10%.

“In 38 years of working in the industry, I have not seen such trends in the market,” said British agent Xenpi Priop.

Perhaps the most important driver of rising prices is interest rates, especially in the United States and Europe. “As mortgage rates begin to rise, real estate markets and large-scale measures to maintain financial stability will be scrutinized,” Shah said.