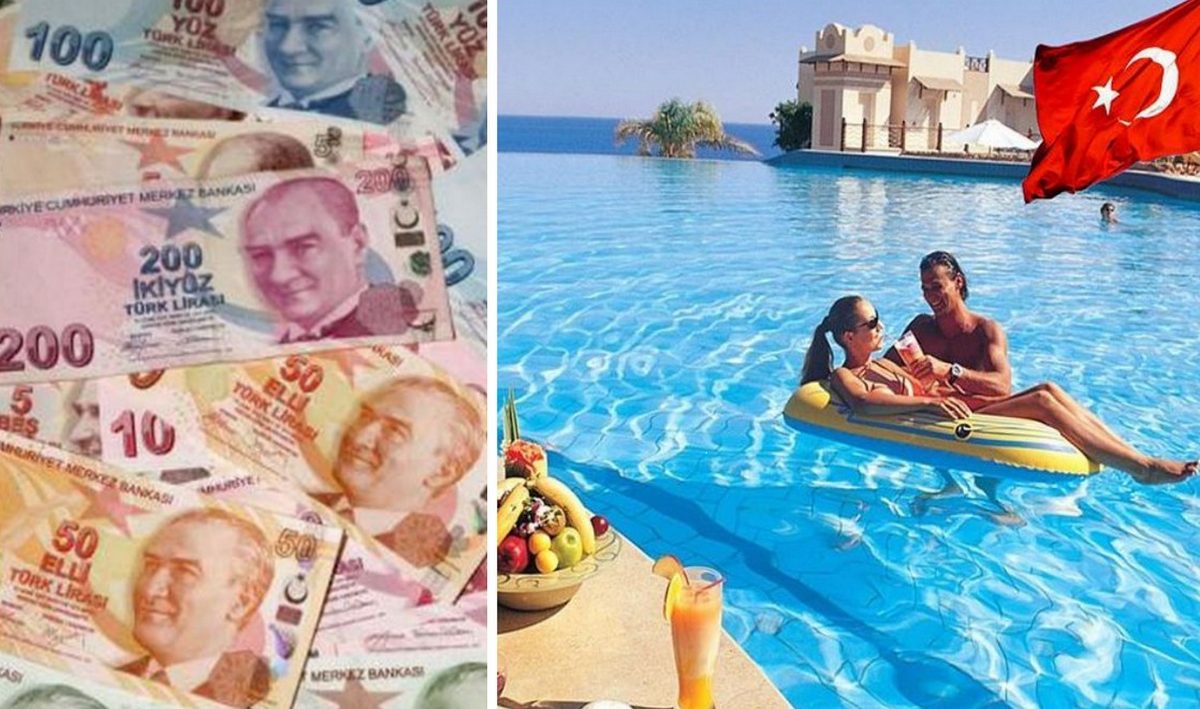

From the beginning of next year, all tourists in Turkey will be taxed. From January 1, 2023, the country will introduce an accommodation tax, which will be charged to all tourist facilities – from 5* ultra all-inclusive to campsites and guest houses. As explained by the Turkish media, referring to the data of the Ministry of Treasury and the Directorate of Financial Revenue, the accommodation tax will be collected from such facilities as hotels, motels, country villages, boarding houses, apart-hotels, thermal facilities, guest houses, mountain houses, etc. . Building

At the same time, it is emphasized that this is a deferred tax. It was planned to introduce a “resort fee” for each overnight stay back in 2019, but its implementation was postponed due to the pandemic. And on January 1, 2023, the tax will enter into force.

As officials explain, the tax is levied only on accommodation services. At the same time, it is stated that “all other services offered in the accommodation facility, which are sold together with the overnight stay service in the accommodation facility, are subject to accommodation tax.” It is about food, active recreation, entertainment services, swimming pools, and thermal areas. “For example, even if the breakfast service included in the accommodation + breakfast option in the guesthouse is separately listed on the accommodation bill or billed for this service, the service offered on the premises will be taxable because it is sold. or it is sold together with overnight accommodation,” officials say.

Taxable, however, will be able to avoid the event, from the congress to the wedding – but only if the service is provided without an overnight stay, the latter will still be taxed. Also, day guests of the hotel who come to use, for example, the spa, swimming pool or water park will not be “chosen” – this service will not be subject to accommodation tax.