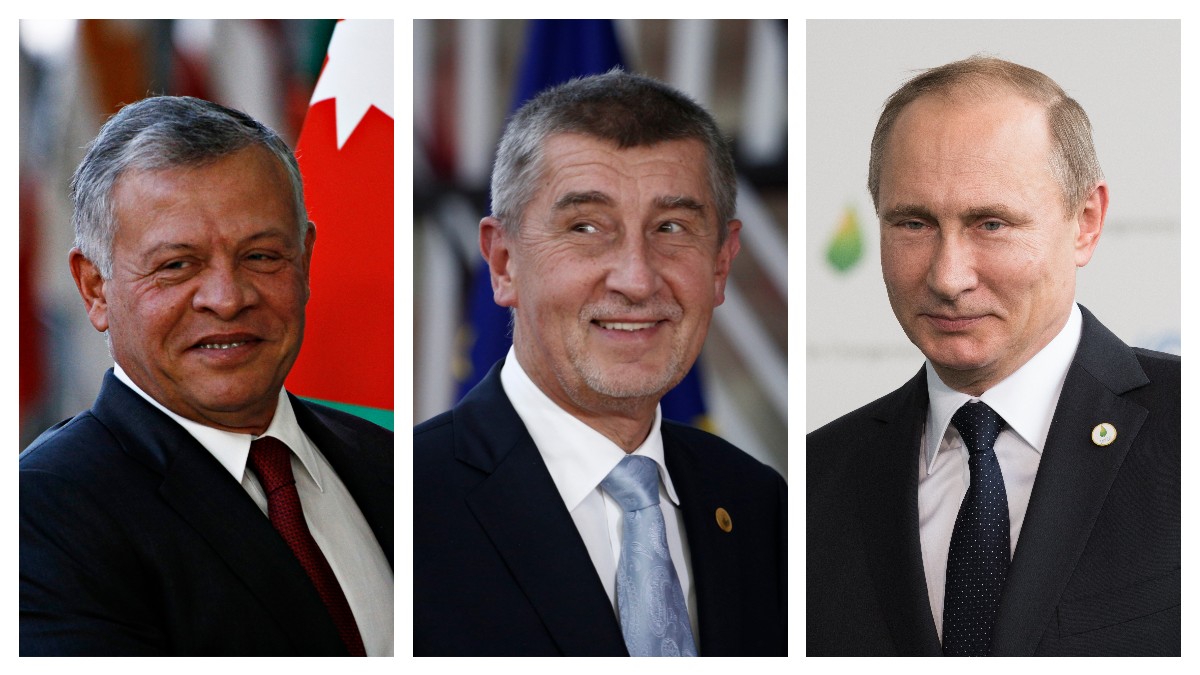

The leaked financial data from the so-called Pandora Papers revealed the assets of world leaders and prominent politicians, as well as the transactions they made to avoid taxation. In total, more than 30 current or former heads of state and more than 300 public figures participate in the disclosed documents.

One of them is King Abdullah II of Jordan, who, through subsidiaries, has amassed over £ 70 million in real estate in the United States and Great Britain.

Luxury Residences

The documents also contain information about property in Monaco owned by Russian President Vladimir Putin. Financial data also suggests the purchase of two luxury mansions in the south of France by the incumbent Prime Minister of the Czech Republic, Andrei Babis.

Investments through companies registered with tax havens total £ 12 million. The Pandora Papers also contains information on how former British Prime Minister Tony Blair and his wife avoided stamp duty when buying an office building in London.

Hiding assets

In total, the Pandora Papers consists of 12 million documents, including emails, spreadsheets and photographs, confirming investments made by companies registered in tax havens, including the Virgin Islands, Panama, Belize, Cyprus and Switzerland.

The documents record transactions made by more than 95,000 companies on behalf of politicians or billionaires. Their goal was to avoid paying taxes or hide the real value of the property. The documents are analyzed by investigative journalists from different countries.